Purpose-built for impact

There is need - and demand - for a comprehensive investment solution which takes impact and returns seriously. Snowball was created to make this type of investing available to everyone.

1/5

Purpose-built for impact

Fairness

Our fees aren’t what you’d expect. We charge a simple flat fee, without a performance element. We call it “non-extractive finance”.

Transparency

We openly share our learning and approach. We published the “warts and all” findings from an independent verification of our impact processes.

Ownership

To guarantee mission-integrity and cement trust, the founders ensured that Snowball owned by charitable or public benefit capital providers. There is no incentive to greenwash.

Equity

More than half our team, board and investment committee are women. Diversifying who and how capital is managed is key to changing investment for the better.

Learning

Our team, expert network and leadership council present and run events for people in mainstream investment to change the way the investment industry thinks and acts.

Mission-locked

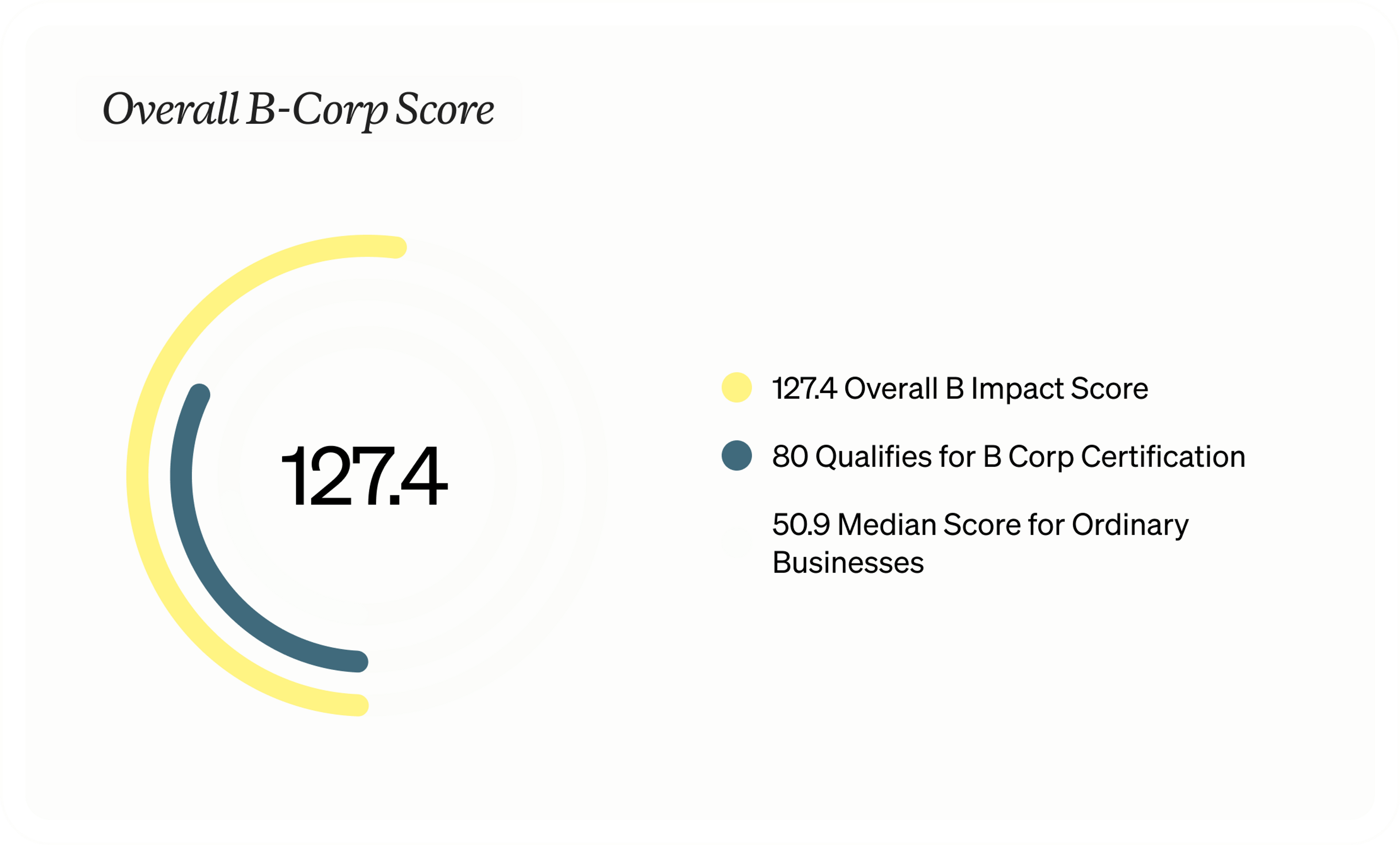

As a B Corporation, our impact mission is written into our articles of association.

Culture

How we work with each other is important. We run an ongoing strengths-based development programme designed to empower every team member.

Governance

We’ve been recognised in the top 5% of all B Corporations for our governance structure, helping us deliver our mission.

Awards & accolades

IA 50 2023 Manager

ImpactAssets is an impact investing trailblazer, dedicated to changing the trajectory of our planet’s future and improving the lives of all people. We're delighted to have been listed for the second year running in the ImpactAssets 50™.

Pensions for Purpose Content Award

We were awarded the Impact Strategy Award by Pensions for Purpose for our work in collaboration with the Impact Management Project on measuring enterprise impact.

Real Deals ESG Awards

We are delighted to win the Real Deals Media ESG Award 'Impact Fund of Funds', recognising the success of our strategy optimising all our investments for positive impact, risk and return. The Real Deals ESG Awards, celebrate those who are making positive change through ESG in private equity.

Investment Week's Sustainable Investment Awards

We won Investment Week's 'Best Sustainable Multi-Asset Fund' at their Sustainable Investment Awards 2023. The entries were judged by a panel of sustainable investment experts from across the industry. In their decision making they considered factors including: strong performance record; strength of the team; meeting the fund’s sustainable objectives; excellence in sustainable investing within the investment process; strong engagement record; effective client communication; wider fund impact; and key developments on the strategy in the year.

Real Leaders Innovative Impact Fund Managers

We were listed in this Real Leaders of Impact Investing special edition '60 Game-Changing Fund Managers', a collaboration between Real Leaders and ImpactAssets. This edition spotlights 60 of the 143 impact fund managers selected across all three IA 50 lists.

Living Wage Foundation

We are a Living Wage accredited employer. The real Living Wage is the only UK wage rate that is voluntarily paid by almost 10,000 UK businesses who believe their staff deserve a wage which meets everyday needs - like the weekly shop or a surprise trip to the dentist.

Our approach to diversity, equity & inclusion

We all have a responsibility to work towards the elimination of persistent inequities and systemic racism in our society. As investors, we can contribute to addressing these inequities by taking intentional steps to promote diversity and inclusion across our portfolio, and in how we operate. We share our efforts to promote diversity and inclusion, and we review and update our approach as we learn from our experience.

45%

female board

66%

female management team

45%

female board

66%

female management team

Our approach to environmental sustainability

Climate change presents a major threat to healthy life on this planet. The financial system is powerful and we believe it has to serve the world better. There is an urgent need for the investment industry to accelerate the just transition towards a net-zero economy. The Intergovernmental Panel on Climate Change has reported that, in order to avoid catastrophic impacts from climate change, we must limit the average global temperature rise to no more than 1.5°C above the preindustrial era. To achieve this target, global carbon emissions must decline by approximately 45% relative to 2010 levels by 2030, and reach net zero around 2050.

Net zero by

2030

Our People

A deliberate blend of seasoned impact and investment professionals

Audit & Risk Committee

Impact Investment Committee

Governance Committee

Board member

Managing director, CEO

Managing director, CIO

Managing director, COO

C. Hoare & Co., Chair

Baillie Gifford Japan Trust plc, Non-executive director

COOK Ltd., Co-chair

Blackrock Greater Europe Investment Trust, Non executive director

Friends Provident Foundation, CEO

Border to Coast Pensions Partnership - Stewardship manager

Path to Impact, Managing director

Principal

Principal

Principal

Manager

Associate

Associate

Associate

Office manager

Network

Leadership Council

Co-Chair Snowball leadership council, CEO, Green Finance Institute. Former Global Head of Green Banking, Barclays

Co-Chair Snowball leadership council, Chairs The Big Exchange Limited

CEO & Co-founder, CityHive

The Baroness Worthington, Crossbench Peers

Founder, Active Philanthropy

Sustainable Finance Professor, LSE, author of The Road to Net Zero Finance for the UK’s Climate Change Committee, Co-founder of the Financing the Just Transition Alliance.

Chair of Access Foundation, Global Ambassador for the Global Steering Group for Impact Investment, Advisory Council, UK Institute for Impact Investment.

Partner & Head of Philanthropy – C. Hoare & Co.

LSE Visiting Professor in Practice, leading a research and engagement project on mobilising private sector capital for public policy priorities and a Responsible Climate Journalism initiative.

Expert Network

Executive Director for the Chatham House Sustainability Accelerator

Curiosity Society, Co-opted to the board of London Community Land Trust and an investment committee member of CAF Venturesome’s community-led housing fund

Co-Founder, CIO at Renewity

Merika Advisory

Microfinance Transparency

Independent Director and Advisor, socially responsible investment and sustainable business

Courageous Capital Advisors LLC

Executive Director of Impact Frontiers

Chief Financial Officer and Head of Investor Relations for Birimian Ventures

PROGESA - FIA Business School, EdenLab, FIA Business School

Director of Impact Advisers Capital Ltd

Impact investment consultant

CEO of The Good Economy

Impact investment advisor

Investors, partners and critical friends

We've shared just some of the investors and partners in Snowball.