Advancing environmental sustainability in how we operate at Snowball

Henry Bacon, Principal, Snowball

Fri 8 September 2023

With each passing day, the reality of the climate emergency’s threat to healthy life for all on this planet is becoming increasingly clear. Given the power of the financial system and its influence over where capital is allocated, our view is that it has to serve the world better. There is an urgent need for the investment industry to accelerate the just transition towards a net-zero economy. The Intergovernmental Panel on Climate Change has reported that, in order to avoid catastrophic impacts from climate change, we must limit the average global temperature rise to no more than 1.5°C above the preindustrial era. To achieve this target, global carbon emissions must decline by approximately 45% relative to 2010 levels by 2030, and reach net zero around 2050.

Net zero

Firstly, when we discuss net zero, we are referring to the balance between the amount of GHG produced vs. removed from the atmosphere. Meeting the goal of being net zero means achieving a balance between greenhouse gases produced, and those removed, from the atmosphere. Imagine an overflowing bath tub. You can stop or slow the flow of water into the tub, but you can also drain out some of the water. This is like removing the emissions.

The UK government is committed to a reduction of 100% from 1990 levels by 2050.

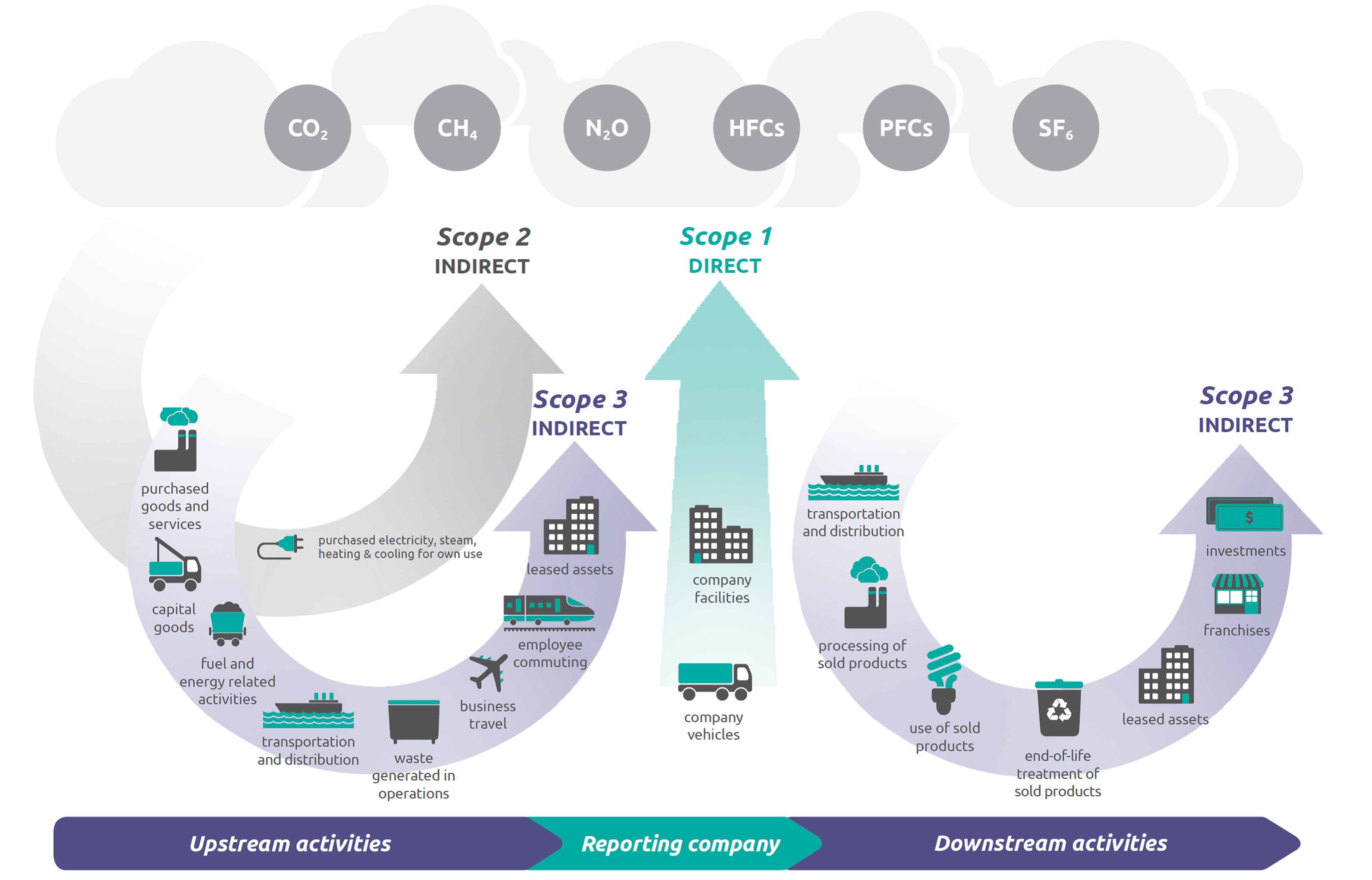

Source: Overview of GHG Protocol scopes and emissions across the value www.ghgprotocol.org

It is important to note here that it is a misconception that emissions avoided e.g. from investments in renewable energy projects (also misleadingly referred to as “scope 4”) can be used to offset scopes 1 to 3 emissions. There is clear guidance from the World Business Council for Sustainable Development that these should be reported separately, and that carbon neutrality can only be achieved through acquisition of carbon removal credits or investments in solutions that capture/reduce carbon such as forestry or carbon capture (and where sale of carbon credits has not already taken place).

Current picture and commitments at Snowball

Today

Snowball operations are carbon neutral.

Over the last two years, we have estimated our greenhouse gas emissions associated with scopes 1, 2 and the portion of 3 emissions relating to employee commuting, working from home, waste and water, electronic hardware, digital footprint and business trips. We purchased off-sets equivalent to the tonnes of carbon emitted. We have also engaged with key suppliers to encourage them to start collecting and reporting emissions data.

Last year Snowball operations emitted 10 tonnes of C02. Given the controversy around the additionality of offsets, we went through an exercise in collaboration with WHEB to identify the most credible offset solutions in the UK. In that process we shortlisted The Wildlife Trust for Beds, Cambs and Northants and Make it Wild because we think they are truly additional, and we are able to verify the offsets have actually taken place. We are happy to share our learnings from this process.

Snowball operations however does not include our investment portfolio (a major part of our Scope 3 emissions), so this a priority in our action plan to measure the carbon intensity of our portfolio.

2030

Target date for all Snowball operations, and investment portfolio, to be net zero, carbon neutral or better. As a multi asset multi manager fund invested in public and private markets, this is an ambitious target given the breadth and types of investments we have.

This is also the date we are working towards having our greenhouse gas emission goals formally validated by the Science Based Targets Initiative.

Methodology

The Greenhouse Gas Protocol and Partnership for Carbon Accounting Standards provide guidance for finance organisations to calculate the carbon emissions of their investment portfolios. There are two options – either rely on estimates provided by underlying investments or assign estimates based on average sector data. Once a company’s emissions have been estimated, each investor is allocated an amount based on its percentage ownership (equity investments) or percentage of the capital structure (debt investments). Emissions intensity of Snowball’s portfolio is calculated by aggregating all emissions and dividing by total NAV to arrive at CO2 emissions/£m invested.

Our current focus is on accurately estimating the GHG emissions of Snowball’s entire investment portfolio. We have made good progress on our public market due to the availability of data (the Net Purpose solution has also helped with this) but private markets has been more challenging due to the levels of required disclosures being less stringent.

Engaging to improve private markets disclosure

To start to address the challenge of gaining a complete picture when it comes to private market investments, we have launched an engagement initiative on top of our regular engagement programme, in order to understand their progress in this area, and to support them improve their disclosures.

We are combining this engagement with questions on their diversity, equity and inclusion too as we believe that environmental and social problems are connected.. From this work, we will share an external report as part of our commitment to transparency – to share our learnings, as well as benefit from input from others.

What we’ve learned

Collaboration is key, being part of sector groups like the B Corporation Finance and Investment Group is important for us to be able to share and test progress. Likewise, we connect with our Expert Network – many of whom sit at the heart of the ‘just transition’ –our investors and peers over best practice.

Being open and transparent about what is possible, and where there are limitations.

One of the key differences about Snowball is that we are offering investors access to diversification, and the deeper impact offered in private markets. This means our relationships with our fund managers are key, so we can work together to improve the quality of information we can collect.

Looking ahead

Net Positive is an approach that means doing more good than bad. At Snowball, our organisational design is “purpose-built for impact”. We want to take a holistic approach in everything we do so that we put our business activity at the heart of actions towards sustainable practice. We aim to be part of the collective effort to influence the wider investment industry to change the way it acts.